The purpose of this page is to encourage and collect the user reviews of a Forex product called FX Binary Code. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at fx.fxbinarycode.com.

day trading

Forex Breakthrough Formula

The purpose of this page is to encourage and collect the user reviews of a Forex product called Forex Breakthrough Formula. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at forexbreakthroughformula.com.

The Disciplined Trader Mastery Kit

The purpose of this page is to encourage and collect the user reviews of a trading product called The Disciplined Trader Mastery Kit. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at thedisciplinedtrader.com.

Cloud Control Trader

The purpose of this page is to encourage and collect the user reviews of a trading product called Cloud Control Trader. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at cloudcontroltrader.com.

Power Trade Formula

The purpose of this page is to encourage and collect the user reviews of a Forex product called Power Trade Formula. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at powertradeformula.com.

Online Stock Profits – Twitter Stock Predictor

The purpose of this page is to encourage and collect the user reviews of a trading product called Online Stock Profits. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at onlinestockprofits.com.

What You Should Be Doing When You Hit A Losing Streak Day Trading

If you have traded the markets for any length of time you know that markets can and will change every so often. The problem with most trading systems is that they are designed for one type of market condition and that is it. As soon as conditions change, you are left with a system that under-performs. The great part about the NetPicks systems is that they are very flexible and can be adjusted to fit different market conditions. The Seven Summits Trader indicators give us access to so many different inputs that we can fine-tune our system should markets change. This gives us an incredible amount of power with our trading.

One Day Swing Trades

The purpose of this page is to encourage and collect the user reviews of a Forex product called One Day Swing Trades. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at onedayswingtrades.com.

Rockwell Trading

The purpose of this page is to encourage and collect the user reviews of a Forex product called Rockwell Trading. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at rockwelltrading.com.

Forex Arbitrage

The purpose of this page is to encourage and collect the user reviews of a Forex product called Forex Arbitrage. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at forexarb.com.

Rapid Forex Profits

The purpose of this page is to encourage and collect the user reviews of a Forex product called Rapid Forex Profits. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at rapidforexprofits.com.

World Class Trading Stars

The purpose of this page is to encourage and collect the user reviews of a Forex product called World Class Trading Stars. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at worldclasstradingstars.com.

Forex Hidden Systems

The purpose of this page is to encourage and collect the user reviews of a Forex product called Forex Hidden Systems. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at forexhiddensystems.com.

Forex Income Domination

The purpose of this page is to encourage and collect the user reviews of a Forex product called Forex Income Domination. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at forexincomedomination.com.

Forex Income Maximizer

The purpose of this page is to encourage and collect the user reviews of a Forex product called Forex Income Maximizer. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at forexincomemaximizer.com.

3 Day Trader

The purpose of this page is to encourage and collect the user reviews of a Forex product called 3 Day Trader. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at 3daytrader.com.

Forex Pip Taker

The purpose of this page is to encourage and collect the user reviews of a Forex product called Forex Pip Taker. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at forexpiptaker.com.

Basic Forex Strategies

The multi-billion-dollar per day Foreign Exchange Currency Market (Forex) is appealing to the individual investor because it is one of the most liquid investments available. In a way, it is a very simple, straightforward type of investing. Prices can either go up, down or sideways.

That is not to say that you can simply open a Forex trading account with a broker and start placing trades, unless your goal as a Forex trader is to become what’s known as, in Forex jargon, a “donor.”

How to Trade Out of a Bad Losing Position in Forex Back into Profit (Part II)

Please read the first part of How To Trade Out Of A Bad Losing Position Back Into Profit to understand this second part. The EURUSD pair starts to fall. You are happy, you plan to add the third lot at 1.3000. If the pair reaches this level, it means that the momentum is there for it to fall more. The pair falls, never reaches this level rebounds and makes a new high at 1.3420.

Trading The Friday To Sunday Extension

As a forex trader, you can exploit the Friday to Sunday Price extension to make 10-30 low risk pips during the weekend while the markets are closed. This trading strategy works very well when there is high volatility on Friday like that what happens on the release of NFP Report.

21 Trading Systems

This is an entry for a Forex product called 21 Trading Systems. The official site for this product is at 21-trading-systems.com. If you’re looking for more info about this product follow the link.

Fibonacci Strike

This is an entry for a Forex product called Fibonacci Strike. The official site for this product is at fibostrike.com. If you’re looking for more info about this product follow the link.

Forex Fortune Signal

This is an entry for a Forex product called Forex Fortune Signal. The official site for this product is at forexfortunesignal.com. If you’re looking for more info about this product follow the link.

Breakout Trading Entry, Exit and Stop Loss Strategies

Breakout trading can be highly profitable. But the problem is most breakouts tend to fail often. A breakout fails when the price returns to a point before the breakout. Suppose the price breaks out above the resistance line but soon retraces back below the resistance line. This means the breakout was false. But in many cases, prices retraces itself slightly above or below an important breakout level before continuing in the direction of the breakout.

Elemental Trader

This is an entry for a Forex product called Elemental Trader. The official site for this product is at elementaltrader.com. If you’re looking for more info about this product follow the link.

Divergence Trading With MACD Histogram

Divergences are considered to be pretty strong trend reversal signals. Divergence happens when the price action and the indicator in this case the histogram moves in the opposite directions. For example, the price action makes a new high while the indicator makes a new low or the price action makes a new low while the indicator makes a new high.

When divergence between the price action and the indicator develops, it means a potential trend reversal in the market. MACD is a very versatile technical indicator that can be used to trade these divergence patterns.

How To Trade With The MACD Histogram

A MACD Histogram is a bar chart. The slope of the MACD Histogram is very important. This is the best indicator that tells whether bears or bulls are controlling the market. An upward slopping histogram indicates that the bulls are getting stronger while a downward sloping histogram indicates that the bears are getting stronger.

The price trend whether up or down is likely to continue if it is in the same direction as the slope of the MACD Histogram. When the slope of the histogram and the price action are moving in opposite direction, it means that the trend is in jeopardy. As a rule, always try to trade in the direction of the slope of the histogram.

How to Be a Top Forex Trader

In the Forex market, everyone wants to become the infamous powerhouse broker with an unending stream of money coming out of their pockets. The reality is, according to Forex brokers, 90% of traders fail terribly because they just do not know what they are doing, how things work, or that they aren’t prepared enough. The other 10 percent, well, consider that only 5% comes even while the other 5% experiences repeated success. How do they do it? In this post, I’ll explain five key principles required to become a power trader:

A Daily Timeframe Strategy That Pulls 100-500+ Pips Per Trade

This is a daily timeframe strategy that can make hundreds of pips per trade for you without you having to spend hours staring at your computer monitor. Wake up in the morning, scan the charts on the daily timeframe, setup your trade and that’s it. After that you are free to do whatever you want to do.

Let’s discuss this Daily Timeframe Strategy. This Daily Timeframe strategy uses only two indicators. These are the Bill William’s Accelerator Oscillator (AC) and the Stochastic Oscillator. The Bill William’s Acceleration/Deceleration Indicator (AC) measures the acceleration and deceleration of the current driving force.

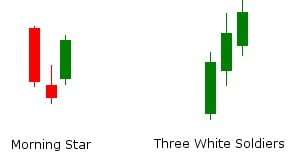

The Morning Star And The Three White Soldiers Candlestick Patterns

Three stick candlestick patterns are more complicated than the single stick and two stick patterns. These patterns take three days to emerge as a valid signal. One such three stick candlestick trend reversal pattern is the Morning Star. However, a Morning Star and the Bullish Doji Star look almost the same but are in fact two different three stick candlestick patterns. You need to know how to distinguish between them.

In case of the Morning Star and the Bullish Doji Star Patterns, the first day is a large bearish candle, the second day in case of the Doji Star Pattern is a True Doji while in case of the Morning Star it is almost a Doji. The price action behind these two patterns is almost the same.

Trading Support And Resistance Using Turnabouts Strategy

When you make a mistake in trading, there are no money back guarantees that can give you back your hard earned money. Turnabout is a conservative approach to trading support and resistance. This is the closest to the money back guarantee that you can get when trading support and resistance.

Support and resistance is one of the key concepts in trading. Support is like the floor of a room. When you hit it with a ball, the ball will bounce up. In the same manner, resistance is like the ceiling of a room. When you hit it with a ball, the ball will bounce down.

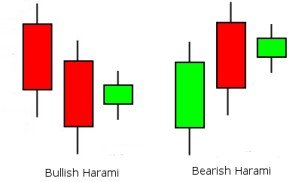

Harami – An Important Trend Reversal Candlestick Pattern

Harami is an important trend reversal pattern. It is a two day candlestick pattern with the candle of the setup day longer than the candle of the signal day. Harami is the Japanese word for pregnant. If you draw this a pattern, it will look like a pregnant woman. The pattern can be bullish as well as bearish.

In case of the bullish harami, the first day is a bearish candle that occurs in a downtrend. On the second day, bulls enter the market and start moving the prices higher but not with much success as the price close lower than the open of the first day and the first day’s high is not surpassed. However, when this pattern appears it culminates in a trend reversal.

ETF Trend Trading

This is an entry for a Forex product called ETF Trend Trading. The official site for this product is at etftradingcourse.com. If you’re looking for more info about this product follow the link.

A Successful Start to Forex Trading

In order to start a home business, one must fully analyze their current financial wit and their capabilities. Investment must come with a strong emotional security because it’s important for you to fully understand that your investments come at a high price, there’s always the risk of total failure. Nevertheless, you mustn’t gamble your money away, you’ve got to be prepared, diligent, smart, and very determined.

Simple Forex Trading Strategy Using Elliott Wave Indicators

Elliott Waves were first discovered by R.N Elliott in the 1930s. What he found was that markets follow a certain wave pattern over the long term as well as on the short term that is repeated over and over again. This wave pattern is now considered to be a universal law of the markets and is named as Elliott Waves Principle.

Stealth Forex Signals

This is an entry for a Forex product called Stealth Forex Signals. The official site for this product is at stealthforexsignals.com. If you’re looking for more info about this product follow the link.

Divergence Trading Using Stochastics

One of the most popular ways to use Stochastics is divergences. A divergence takes place when the price and the stochastics diverge from following the same path. For example, if the price makes a new low but the stochastics don’t, it is a divergence. In the same way, if the stochastics make a new high and the price doesn’t, it is again a divergence.

Now, keep this in mind that divergence on a daily chart is quite different than the divergence on the weekly chart. Divergence on the daily chart means that the price will make a short term counter trend move in the next one to five days.

Stochastics For Forex Traders

Stochastics is one of the most popular indicators in forex trading. You can find it on almost all platforms and charting services. But most traders use them incorrectly. Stochastics is an oscillator that has two components %K and %D. This is the formula to calculate K=100(C-L)(H-L) where C is the Close, H High and L the Low of the period. Typically this period is 14 days. However, 9 days period is also popular. %K is the 3 day MA of K and %D is the 3 day MA of %K.

Fortunately, you don’t have to go into all this maths unless you want to fiddle with it and see if you can make it work better. One common question is how many days to use in Stochastics. Stick with 14 days as it is the default. Longer period means lesser signals and lower whipsaw while shorter periods means more signals and more whipsaw.

A Channel Breakout Trading Strategy

A Channel is formed when we draw a trendline and then a line parallel to the trendline with most of the price action if not all falling between the two lines. By scanning through a few charts, you will find that it is easy to identify channels. Channels occur frequently.

However, currencies rarely stay in a narrow range for long and have a tendency to breakout from a tight range and develop a strong trend in the market. Important economic news releases can act as a trigger for a breakout.

Ultimate Swing Trader

This is an entry for Ultimate Swing Trader: (official website: ultimateswingtrader.com) Please leave your comments or reviews below. If you …

FX Loophole

This is an entry for FX Loophole: (official website: fxloophole.com) Please leave your comments or reviews below. If you want …

200 EMA Forex Strategy For Beginners Called Bucking The Trend

The challenge for many new forex traders is to identify the overall trend on the intraday charts. The 200 Exponential Moving Average (EMA) can solve the problem for them. 200 EMA is one of the most popular technical analysis indicators amongst forex traders.

The challenge for many new forex traders is to identify the overall trend on the intraday charts. The 200 Exponential Moving Average (EMA) can solve the problem for them. 200 EMA is one of the most popular technical analysis indicators amongst forex traders.

In order to use the 200 EMA Forex Strategy open the 4 hour, 1 hour and the 15 minute charts on your MT4 Platform. Plot the 200 EMA on these 3 charts and color it red.

Tile the three charts in a vertical fashion so that you can view the three charts one above the other. Now, scroll through the various currency pairs like the EUR/USD, GBP/USD, USD/CHF, USD/JPY, USD/CAD, EUR/JPY, AUD/USD, NZD/USD, EUR/CHF or whatever pair you like to trade.

Forex Innovator

This is an entry for Forex Innovator: (official website: forexinnovator.com) Please leave your comments or reviews below. If you want …

Momentum Forex Trading Strategy for Traders Lacking Patience

Many new forex traders lack the patience to wait days for a trade to develop. These types of traders want the trade to turn into a profit within minutes of entering into the trade. If it doesn’t, they usually abandon the trade as they lack the patience to follow it through. These type of traders are more than happy to make 10 pips multiple times a day instead of making something like 100-200 pips in a trade with the potential of the trade going against them in the beginning.

For these type of traders momentum trading is the best forex trading strategy. The aim of this short term momentum forex trading strategy is to hit the profit target as early as possible. This is achieved by entering the market long or short when the momentum is on your side.

Copy Live Trades

This is an entry for Copy Live Trades: (official website: copylivetrades.com) Please leave your comments or reviews below. If you …

Forex Jackhammer

Forex Jackhammer is a completely automated Expert Advisor for MetaTrader platform.

Forex Jackhammer is a completely automated Expert Advisor for MetaTrader platform.

Forex Outbreak

Forex Outbreak is a new Expert Advisor for MetaTrader platform to trade multiple currency pairs automatically with any major Forex broker.

Forex Outbreak is a new Expert Advisor for MetaTrader platform to trade multiple currency pairs automatically with any major Forex broker.

Seven Summits Trader

Seven Summits Trader is a trading strategy created by NetPicks company and it is for trading Forex, futures, stocks and ETF in multiple time frames.

Seven Summits Trader is a trading strategy created by NetPicks company and it is for trading Forex, futures, stocks and ETF in multiple time frames.

Forex Hippo

Forex Hippo is a fully automated Expert Advisor trading all major currency pairs.

Forex Hippo is a fully automated Expert Advisor trading all major currency pairs.

Quantum FX Pro

Quantum FX Pro by Kishore M is a Forex trading course and a manual trading system.

Quantum FX Pro by Kishore M is a Forex trading course and a manual trading system.

Forex Supersonic

Forex Supersonic is a 100% automated Forex trading robot that according to the authors is simple but works.

Forex Supersonic is a 100% automated Forex trading robot that according to the authors is simple but works.

10K to 1MM Trading Formula

10K to 1MM Trading Formula by Henry Liu is a DVD video Forex trading course teaching one system that has a goal to take you from $10,000 to $1 million in one year.

10K to 1MM Trading Formula by Henry Liu is a DVD video Forex trading course teaching one system that has a goal to take you from $10,000 to $1 million in one year.

Forex Legend

Forex Legend is an Expert Advisor developed by a team of experienced Forex traders and claims to be the revolutionary Forex robot. Don’t they all?

Forex Legend is an Expert Advisor developed by a team of experienced Forex traders and claims to be the revolutionary Forex robot. Don’t they all?

Xtreme Pip Poacher

Xtreme Pip Poacher is a new multi-currency Forex trading automation software created by a Forex system developer with 26 years of trading under his belt.

Xtreme Pip Poacher is a new multi-currency Forex trading automation software created by a Forex system developer with 26 years of trading under his belt.

Forex Ultimate System

Forex Ultimate System by Robert Iaccino is a Forex signals services that delivers signals to the user’s computer via software.

Forex Ultimate System by Robert Iaccino is a Forex signals services that delivers signals to the user’s computer via software.