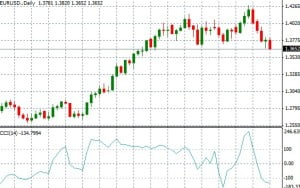

Using the higher timeframe to confirm a trading signal on a lower timeframe is a skill that can be highly rewarding for a trader. Many traders take a trade that is coordinated on the lower timeframe but not the higher timeframe which often gives them bad trades and a waste of time and energy.

Suppose, you find the trend on the intraday chart and the trend on the daily chart in the same direction, it is like having the wind at your back.If you can master the art of identifying currency pairs that have the intraday trends in the same direction as the daily and the weekly trends, you can reap immense rewards.

The challenge for many new forex traders is to identify the overall trend on the intraday charts. The 200 Exponential Moving Average (EMA) can solve the problem for them. 200 EMA is one of the most popular technical analysis indicators amongst forex traders.

The challenge for many new forex traders is to identify the overall trend on the intraday charts. The 200 Exponential Moving Average (EMA) can solve the problem for them. 200 EMA is one of the most popular technical analysis indicators amongst forex traders.