Welcome to Part 3 of this tried-and-tested FREE Forex strategy. If you’ve managed to missed the first two parts I highly recommend you check them out; you can find Part 1 here and Part 2 here.

We’re going to go through a specific example trade. This will give you an idea of how simple and easy this strategy really is. It will also give you an idea of how profitable it is as well!

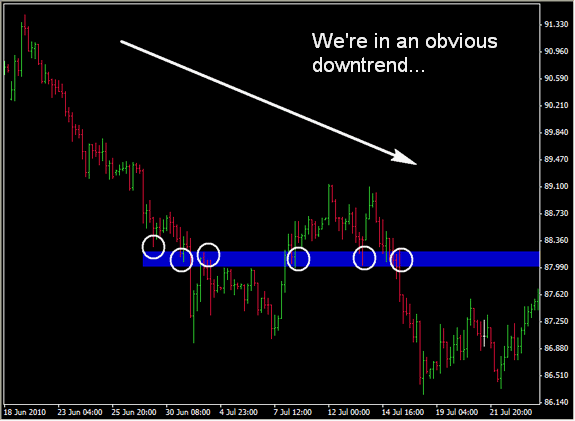

First we identify the recent S/R levels, This is done as easily as this:

If you’re not comfortable right now in identifying S/R then you will be very shortly. I promise you that it does not take long to master S/R.

We can clearly see in the above chart that the trend is down. What does this mean? It means we will only be looking to sell – remember Rule #2: trade with the trend.

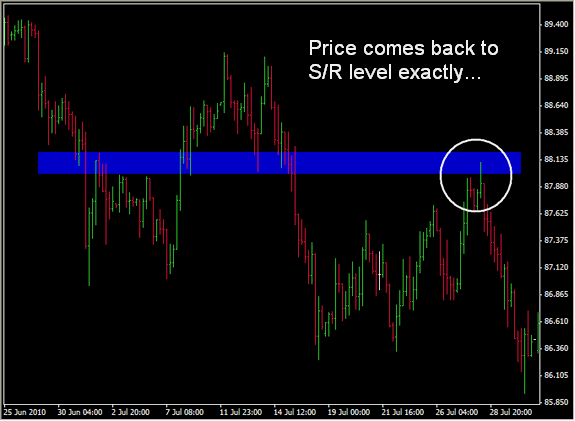

Now that we have our S/R we wait for price to come back to the S/R area just like in this trade example:

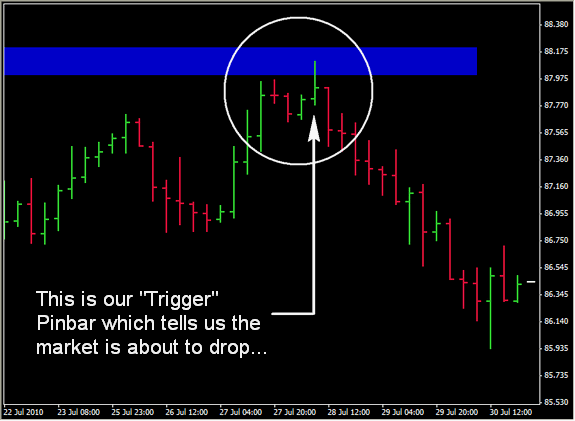

If we zoom in a little we can see our “trigger” on this trade; a Pinbar right at the S/R level as the market TELLS us where it is going (hint: down!):

And sure enough the market drops:

This was the entry to the strategy; the exit is just as important.

In the Fourth and final part of this free strategy I will go through an extremely effective and profitable exit strategy for you.

Continue to Part 4 of How To Beat Forex When You Have A Day Job

Hi,

would you kindly explain to me what is the ” S/R ”

thanks + regards Heribert

Hi Heribert,

S/R stands for Support & Resistance.

I’m not sure if that’s all the explanation you want but I’ll give more anyway…

When price climbs higher, reaches a particular level (say the 87.25 area), then falls – we can say that price found resistance there.

If price rises again, reaches the 87.25 area once again, and then drops off – this resistance is confirmed further.

Support is the same as this except price is coming DOWN to a level as opposed to rising up to it.

The whole point of using S/R is that if price found support or resistance at a particular level in the past… there is a chance it will find it again in the future (this is where we use this knowledge as our ‘edge’ in trading).

Robert

Lovely way to find out S/R!

Thank you!

Ionel

Hi Robert,

What sets the trigger pinbar apart from all the others?

Regards,

Ron

Hi Ron,

Simply this:

The key is WHERE the Pinbar occurs.

Technically a Pinbar is only a Pinbar if it is occurring at a swing-high or swing-low. If it’s just occuring in “noise” then it’s ignored.

In other words, the Pinbar is only our “trigger” for entering a trade (but an important one!), all the other factors that create the setup are the core of the setup.

Robert

Hi Robert,after reading your article i am up 70pips on the usd/cad. thanks a lot for your help.Denis,

Pleased to hear that Denis.

I’m thinking that was the daily chart??