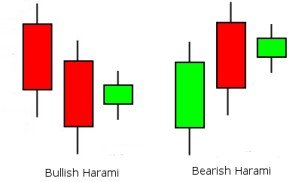

Harami is an important trend reversal pattern. It is a two day candlestick pattern with the candle of the setup day longer than the candle of the signal day. Harami is the Japanese word for pregnant. If you draw this a pattern, it will look like a pregnant woman. The pattern can be bullish as well as bearish.

In case of the bullish harami, the first day is a bearish candle that occurs in a downtrend. On the second day, bulls enter the market and start moving the prices higher but not with much success as the price close lower than the open of the first day and the first day’s high is not surpassed. However, when this pattern appears it culminates in a trend reversal.