Learn how crypto bot trading strategies can help automate your trading and potentially increase your profits with less effort.

Key takeaways:

- Moving averages (SMA, EMA) help identify trends and buy/sell signals.

- Fibonacci Retracement Strategy predicts price pullbacks using Fibonacci ratios.

- Arbitrage bots exploit price differences across exchanges for profit.

- Consider risk tolerance, complexity, fees, and historical performance when choosing a bot.

- Benefits of bot trading include speed, 24/7 operation, emotionless trading, market monitoring, and customization.

Moving Average Trading (SMA, EMA)

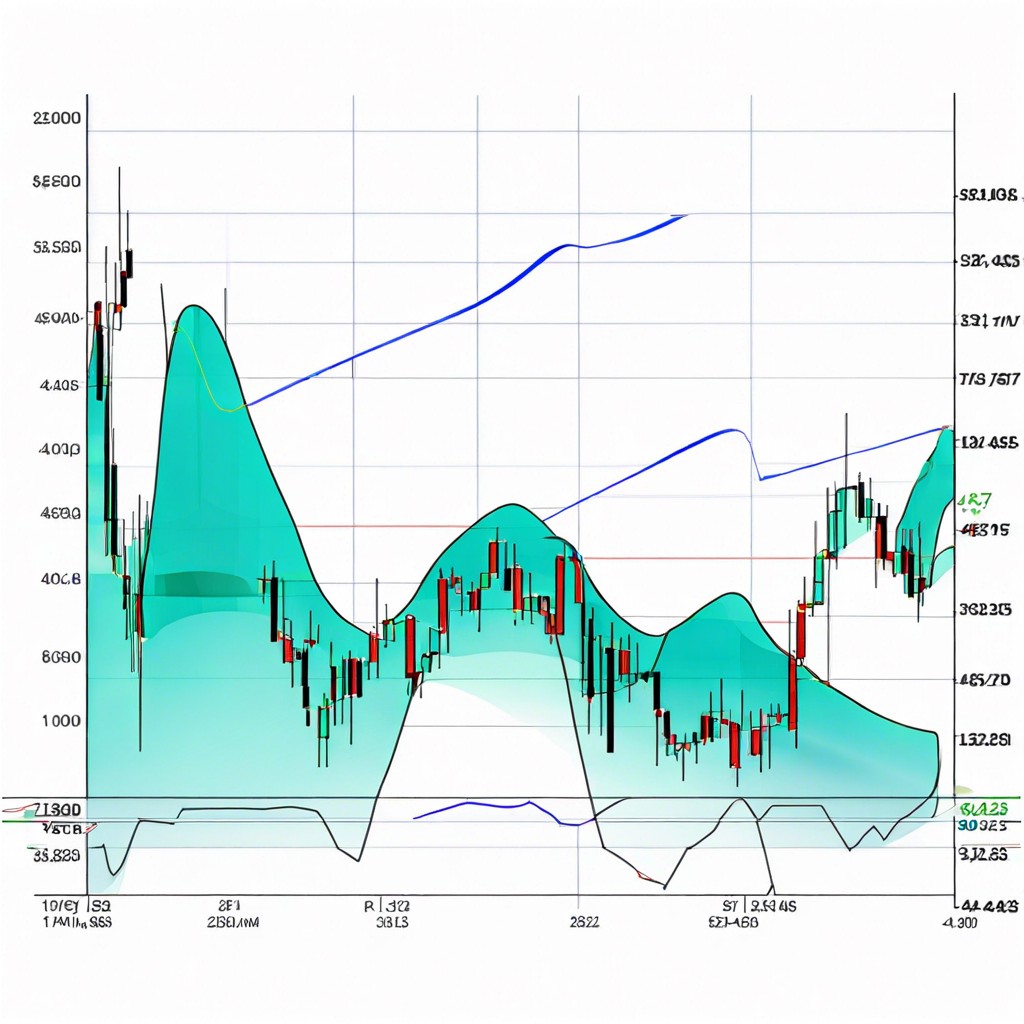

Moving averages are essential tools in bot trading, helping to smooth out price data and identify trends. They come in two flavors: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

SMAs are the vanilla of moving averages. They calculate the average price over a specific period. For instance, a 50-day SMA takes the closing prices of the last 50 days and averages them out. The result? An easy-to-spot trendline that gives you a clear indicator of market direction—like a financial weathervane.

EMAs, on the other hand, add a bit more spice. They give more weight to recent prices, making them more responsive to new information. Think of EMAs as SMAs after a strong espresso shot. If you’re dealing with a highly volatile crypto market, an EMA can offer quicker reactions to price changes, ensuring your bot is nimble.

Both SMA and EMA can help identify buy and sell signals. For example, if an asset’s price crosses above its 50-day SMA, it might be time to buy. Conversely, if it dips below its 200-day EMA, selling could be wise.

The beauty of these moving averages? They can be layered. Many traders use multiple SMAs and EMAs to confirm trends, making your bot a multi-tasking maestro. In essence, moving averages provide a simple yet powerful way to guide your bot through the ever-changing crypto jungle.

Fibonacci Retracement Strategy

This one’s for the math enthusiasts! The Fibonacci Retracement Strategy uses sequences to predict potential price pullbacks. Sounds complex? It’s not.

Imagine prices going on a roller-coaster ride. The bot identifies key levels using Fibonacci ratios like 23.6 percent, 38.2 percent, 50 percent, 61.8 percent, and 100 percent. These aren’t just random numbers—they’re believed to act as strong support or resistance points.

- Here’s how it works:

- The bot plots the Fibonacci levels during a trend (up or down).

- It waits for the price to pull back to one of these levels.

- Once it hits a level, it looks for confirmation signals (like volume increases) to jump in on the action.

It’s like a super-precise treasure map, but instead of gold, your prize is profit potential. No need to be a Fibonacci genius—just let your bot do the math. Happy trading!

Arbitrage Bot Strategy

Ever dreamed of being a financial wizard who can be in two places at once? Well, arbitrage bots make that dream real. This strategy involves exploiting price differences of the same asset across multiple exchanges. Essentially, it’s like buying bananas at your local grocery store for a dollar and selling them across town for two. Cha-ching!

- Here’s how it works:

- First, the bot scans multiple exchanges, such as Binance, Bitfinex, and Kraken, to identify price discrepancies.

- Once it spots a sweet deal, it buys low on one exchange and sells high on another.

- This happens at lightning speed, far faster than any human could manually accomplish.

Imagine these bots as the Indiana Jones of trading, constantly hunting for hidden treasures. However, like our whip-wielding hero, they need to dodge pitfalls. You’ve got to consider transaction fees, withdrawal times, and the risk of prices converging before the trade executes.

In essence, arbitrage bots capitalize on market inefficiencies. They might not come with a fedora or theme music, but they sure know how to find an opportunity.

How to Choose the Best Crypto Trading Bot Strategy

Start by evaluating your risk tolerance. If you hate roller coasters, opting for high-risk, high-reward strategies might not be your cup of crypto tea.

Consider the complexity of the bot. A rocket scientist might love a complicated algorithm, but if you’re more of an “if I can’t plug-and-play it, forget it” type, choose something user-friendly.

Check the fees. Some bots cost more than a fancy cup of coffee every day. Make sure the potential returns outweigh the costs.

Review the historical performance. Imagine being able to look at your bot’s diary and seeing all its past wins and losses. Historical data can give you a sneak peek into what you might expect.

Pay attention to the support and community around the bot. A lively, helpful community can feel like you’ve got a pit crew always ready to assist, versus you and your bot against the world.

Remember to stay updated. The crypto world moves faster than a cat on a hot tin roof. Ensure that the bot developer provides regular updates to adapt to market changes.

Benefits of Crypto Trading Bot Strategies

Bots can trade faster than a caffeinated squirrel, executing complex strategies much quicker than any human ever could.

Bots operate 24/7. Markets don’t sleep and neither do bots. This lets you dream about your next vacation while your bot works nonstop.

They eliminate emotional trading. Fear and greed are no match for the cold, calculated decision-making of a trading algorithm.

Bots can monitor multiple markets and currencies at once. It’s like having an army of clones tirelessly scanning for profitable opportunities across the globe.

They follow rules to the letter. No second-guessing, no hesitations. If a certain condition is met, the bot acts, ensuring consistency in strategy execution.

Customized strategies. Tailor your bot to follow your unique trading plan, tweaking parameters to suit your goals and risk tolerance. Think of it as your personal robo-advisor.