Many traders make a good living catching changes in the trend. Catching a trend change means trying to pick the top or bottom of a trending move. It is not easy but it can be highly rewarding if done correctly. Bullish and bearish Engulfing Candlestick Pattern is one of the most popular patterns used by these type of traders to anticipate a trend reversal.

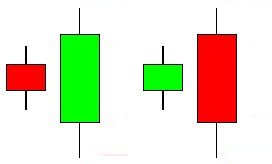

This is a two stick pattern meaning it takes two days for the pattern to develop. The pattern’s name comes from the fact that the signal day completely engulfs the setup day. So the candle body and the wick on the signal day engulfs the candle body and wick on the setup day.

In case of the bullish engulfing pattern, the first day is down. But on the second day, heavy buying starts in the market. So much buying in the market takes place that it completely surpasses both the open and the high. On the other hand, in case of the bearish engulfing pattern, the setup day candle is bullish. On the signal day, heavy selling starts in the market forming a bearish candle that completely engulfs the first day candle.

The power of the engulfing candle is increased by its size. The bigger the engulfing candle, the more significant it will be. A large bullish engulfing candle says the bulls have seized control of the market after a downtrend. Similarly, a large bearish engulfing candle says bears have taken control of the market after an uptrend.

Bullish and bearish engulfing patterns warn of trend change before it happens. When you combine the appearance of these candles with other technical indicators like the Commodities Channel Index (CCI), you should quickly pick up on trend changes. The ability to pick up trend changes is the key to positioning yourself on the right side of the market!

So, in case of a bullish engulfing pattern, on day one bears dominate the market. The open is near the high. Bears push down the prices all day until the close ends up near the low. On day two, the bears again push down the prices a little bit before the bulls come into action and start pushing the prices up never stopping. The bulls exceed the prices of the previous day and even push the prices up over where the trading started the previous day.

Appearance of the bullish engulfing pattern means that the bulls are going to continue to push the prices up for days to come. The exact opposite happens in case of the bearish engulfing pattern. Bears take hold of the market for days to come!