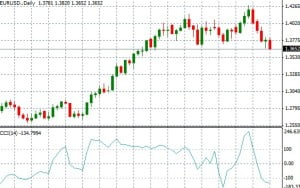

Commodities Channel Index (CCI) is an oscillator that measures the strength of the current market cycle and attempts to predict when it will end. CCI indicator default measurements are +100 to -100. When the indicator is above +100, the market is considered to be overbought and when it is below -100, the market is considered to be oversold.

Commodities Channel Index breakouts occur when it falls below +100 or rises above -100. Most traders are taught to buy when the breakout from the oversold market takes place and sell when the breakout from the overbought market condition takes place. In this CCI Breakout Trading Strategy, we will be using a variation of this by combining the Commodities Channel Index Breakouts with our usual support and resistance on the Daily Charts.